Cetelem Online Personal Loan Request

Cetelem is the most known brand of BNP Paribas Personal Finance, one of the biggest players in personal loans and co-branded credit cards in Portugal. This project was the first wave of a big change in the digital transformation of the bank. Not only it was a complete re-design of the main online channel with many improvements on the User Experience but also a complete shift on the technology platform that support the CMS moving away from Joomla to a more secure CMS as is LifeRay.

Technology

Html5 - CSS3 - Javascript

Liferay

Methodology

Agile / Scrum

Team Size: 11

Work

User Research

User Interface Design

Wireframes

After the discovery phase that included the Competitor Analysis and Audience Definition that allowed to get valuable insights on how to present Cetelem offers in the Portuguese market the focus was to setup some initial wireframes and iterate on those with every stakeholder.

After the initial interviews with every Product Owner, that serve to understand their needs, goals and KPIs, they were key partners in the development of the wireframes in an Agile environment that allowed to speed up this project phase and to be more precise in each iteration.

By being a active player in the Design Thinking sessions, all BUs were a valuable resource in order to help on the definition of the User Cenarios and alining this with each business goals.

Every Business Unit, from Personal Loans and Credit Cards to Legal and Compliance, had the chance to help in the co-construction of their product pages achieving a higher feeling of dedication, ownership and support, by playing a active role in decision making in every step of this process.

Simulators

This product component was probably the most critical, since it was the primary interaction for users with the Cetelem products. Despite having the major role in generating leads, the simulators are the main touchpoint in the user journey. Here users can setup their initial proposals to onboard and get financing achieving the primary needs.

The main requirement was to have a simulator that, not only be ok from the legal and compliance perspective, but also could deliver what users expect from it in a simple and understandable way.

One of the major breakthroughs was the possibility to simulate from the instalment giving the possibility of users to find out the number of instalments needed to pay the initial amount by choosing the instalment that better fitted their budget.

Personal Loan Request

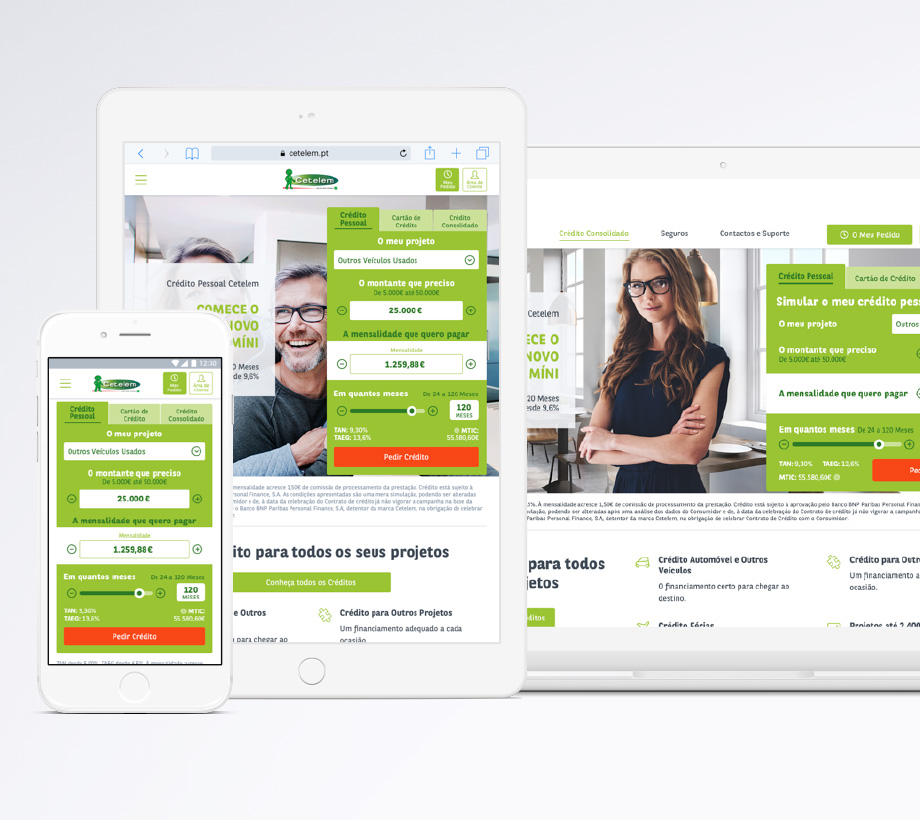

The user journey for any Cetelem product stars here. The main goal to achieve was to have a fully online process that holds several user flows and could manage different approaches for different products and users always with a mobile frist design.

To achieve this, a big effort was made to get this journey as straightforward as possible with the simplification of all data inputs on the credit request form and with a new flow to request the right data at the right time by postponing the gathering of some information for after the scoring decision.

There was also the business need to get more organic traffic that was achieved with a good SEO strategy and a infrastructure development that prioritizes performance.

A mobile first approach was essential to accommodate not only the new cross device demand throughout the user journey, but also to close the gap between the user basic needs and business goals.

Advanced Simulation

The second step in the process is the Advanced Simulation where users can see all the details of the Credit Request. At this point users can still change the initial simulation and decide if they want to subscribe the Credit Insurance. All legal information like the FINE and interests rates are at the users disposal. On the sidebar are set the constrains to apply for a credit and a Click-to-call ready for help them if any doubt ou question arises.

Personal & Professional Data

The initial step of the credit request is the user identification and the insertion of the personal and professional data in order to setup a risk scoring for this prospect user. All inputs were revised and simplified making the most of the best practices in User Experience and in most cases provide a pre-filled information to ease the user, specially on mobile devices were filling a long form is always a pain-point. At the sidebar, throughout the form is presented the overview of the current request application and a click-to-call to assist users if any problem happen.

Request Decision & Secundary Info

This step is the prospect user confirmation, or denial of the credit request. The decision of shifting some secondary information, not needed for assess the users scoring, to after the decision was taken to make the user more keen of providing this information, making the initial form more fast to finish and more easy to get a credit request decision. After this secondary information is provided, the users receive an email with the credit contract and all the necessary information on how to proceed to finish the request.

Process Decision

After the request decision user has to choose between the digital process or the paper process. This is a pivotal point in the user flow for the remaining process. Here users can decide whether they feel more comfortable in printing out the credit contract and send it by mail together with all the requested documentation, or follow a faster process by digitally sign the contracts using a SMS Token and uploading all the necessary documentation to finish the credit request. By choosing the digital process users can, at any time, discard this process and resume it later on, or follow the paper process.

Digital Signature

Here is the most disruptive point in the credit request, since users at this time don’t have a mental model that support the digital signature. After the KYC (Know Your Costumer) of the user is done, we were able to offer users the possibility of signing digitally all contracts using a simple OTP (One Time Password) Token by requiring a QTSP (Qualified Trust Service Provider) a timestamp that enables the legal outcome necessary to qualify this contract signature.

Documents Upload

For a faster and comfortable process, users can upload all the required documentation at this step. In order to finish the credit request it’s presented the list of all the necessary documents they need to upload, or on mobile devices, simply take a photo of the document. It’s very common that users don’t have all the required documents at hand when applying for a credit, but they can bypass this step and resume it later on the Credit Request Status private area.

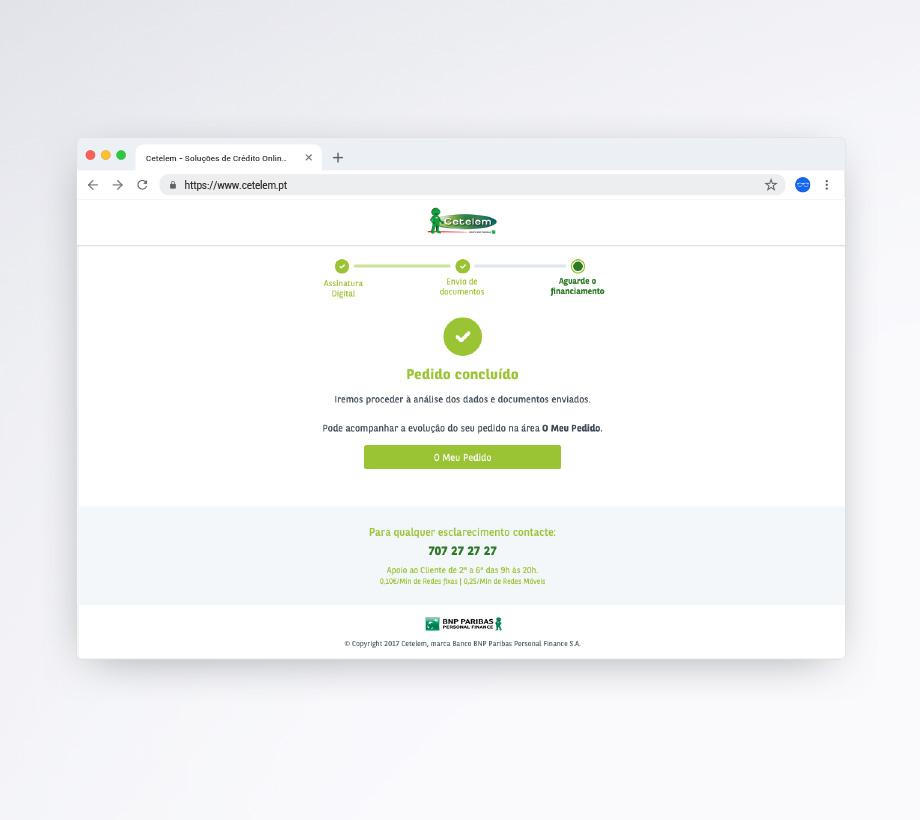

Process Conclusion

The final step is a confirmation that all is done and the user just need to wait for the documents and data validation in order to get the requested amount. Here users are informed that they can track the process in a private area.

Credit Request Status

After completing the credit form users can signin in this private area and follow the status of the credit request. In here users can upload or replace any document that have issues and even digitally sign the contracts.